News & Events

FAISAL ISLAMIC BANK KICK STARTS ITS TRANSFORMATION PROGRAMFAISAL ISLAMIC BANK KICK STARTS ITS TRANSFORMATION PROGRAM

PRESS RELEASE

Date: February 28, 2021

FAISAL ISLAMIC BANK KICK STARTS ITS TRANSFORMATION PROGRAM

Sudan's leading Bank, Faisal Islamic Bank (FIB) has launched its transformation program - "Project Taghyeer" which is aimed at overhauling the entire organization centred around its core values, its customers and employees. The program is in continuation of the new strategy developed by FIB with a redefined vision and long-term objectives.

The transformation exercise will focus on initiatives targeted towards revenue growth, operational efficiency and customer-centricity such as new product launches, organization restructuring and third-party partnerships. Effective change management and communication with the internal and external stakeholders of the Bank have been identified as the key enablers for the transformation. FIBS will leverage new-age digital tools and techniques to ensure that transformation is successful, thereby satisfying all its stakeholders' needs, including customers, employees, regulators, partners and other financial institutions.

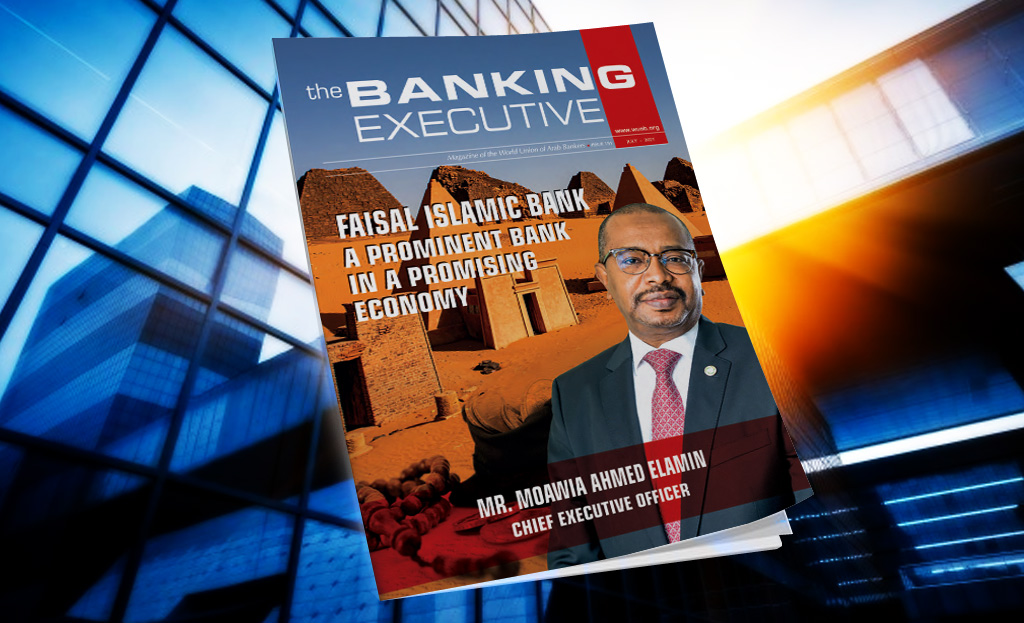

Mr Moawia Ahmed Elamin, CEO of Faisal Islamic Bank, said, "The program is a bold & timely initiative towards the total transformation of the Bank given the changing customer needs following the pandemic. Our transformation journey will help us drive growth and add value to all the stakeholders of the Bank. With this initiative, the Bank has entered a new era. With the active involvement of 1200+ plus workforce of the Bank aided by Deloitte's proven expertise, we are determined to make it a "Model Transformation" in the "Sudanese banking sector".

Senior leadership from FIBS, said, "The Sudan economy is posed with significant challenges, but we are tackling it one by one. The US sanctions were partially lifted; the government is trying its best to control inflation and currency fluctuations. As a leading bank in Sudan, FIBS plays an essential role in shaping its economy by offering best in class financial products and services. The Bank is also in talks with multiple organization to support the most impacted MSME and export sectors during the COVID 19".

The transformation program was strongly supported by the board of directors, senior leadership, and executive employees. This will be a turnaround for FIBS and will help the Bank gear up for a transition towards a full-scale universal bank.

CEO

FIBS